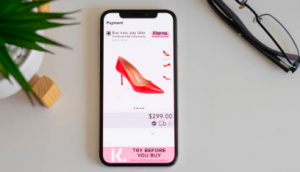

Buy Now Pay Later (BNPL) is considered as the future of millennial finance, with spending reaching £27 billion in the UK alone, and $995 billion globally by 2026. With e-commerce volumes jumping 4-6 years due to the pandemic, consumers and merchants have resulted to BNPL to meet online shopping demands and alleviate financial pressure. BNPL is the fastest growing e-commerce payments method thanks to the pandemic and endless lockdowns many countries had to face throughout 2020 and 2021. With BNPL companies such as Klarna, Clearpay and Laybuy dominating the market, traditional banks are stepping into the competitive landscape hoping to benefit from the surge in BNPL. Whilst the growing popularity of BNPL methods is changing the payments industry as we know it, many regulators are raising red flags due to the fact that it encourages consumers to take on more debt.

What is BNPL?

Buy Now Pay Later is a niche form of credit that is driven by a desire for flexible payment options and the aversion of credit card interest. BNPL provides consumers with a seamless purchasing experience that is characterised by transparency, convenience and flexibility. BNPL is estimated to account for 10% of UK online spending by 2024. Buy Now Pay Later includes no late fees, low or no interest, high loan limits and no credit checks. BNPL providers give such credit out to consumers in return fro lucrative commission from retailers. By 2026, it is predicted that Britons will spend £10 billion per year through BNPL as it becomes more accessible to consumers. Combined with Barclays bank hope to offer credit through BNPL to Amazon’s UK customers, and Monzo being the 1st bank to roll out BNPL, securing credit limits of up to £3000, BNPL is set to take the industry by storm

The Surge in Buy Now Pay Later:

Buy Now Pay Later does not only allow consumers to spend more, but also helps merchants increase their online sales conversion and lower user acquisition costs. With BNPL the cost of an item is spread overtime, allowing consumers to pay in smaller instalments. Allowing consumers to purchase without paying the bill immediately, makes expensive products more affordable. NASDAQ reported that 7 out of 10 consumers prefer BNPL to traditional credit cards, citing affordability and ease of management as key reasons. With BNPL, transactions don’t get reported as long as a payment is not missed, thus not alerting an individual’s credit score.

COVID changed the payments industry, with consumers wanting to be in control of how they pay, demanding greater transparency and convenience. Buy Now Pay Later got a boost during COVID-19, with a NASDAQ report indicating that 35% of consumers tried BNPL for the first time during the pandemic. The boom in online shopping during lockdowns, and the ongoing financial security the pandemic carried, forced many consumers to turn to Buy Now Pay Later solutions. BNPL has provides a lifeline for many in the pandemic, helping them make ends meet buying essentials when needed and paying at a time that suits them.

The Curse of Buy Now Pay Later:

Buy Now Pay Later is encouraging consumers to partake in unsustainable spending and reliance on debt. A common reason for the use of BNPL is for consumers to make purchases that don’t fit in their budget, and to avoid paying credit card interest. Given that a majority of the time, BNPL providers do not undertake affordability checks, such solutions allow consumers to be fiscally irresponsible, racking up debt.

Buy Now Pay Later schemes do not give consumers the opportunity to understand the consequences of their purchases. Due to the lack of protection, consumers are unaware of what they are signing up for. There are a number of risks of BNPL due to the lack of credit checks and its opaque debt recording. BNPL debt is often not visible on a customer’s credit file, and as such borrowers try to get BNPL from multiple providers. The inability to check a consumer’s credit history leads to lenders underestimating borrower’s debt levels. As such, the industry has already witnessed a number of compensation claims by customers who claim that they were mis-sold loans they simply couldn’t afford.

In 2020, the use of Buy Now Pay Later quadrupled to £2.7 billion in transactions, a fraction of the £250 billion of outstanding consumer debt. Younger consumers are more likely to miss BNPL payments. In the UK 10% of a bank’s 660,000 consumers who used BNPL providers exceeded their overdraft. One third of US consumers who used BNPL have fallen behind on one more payments with 72% claiming their credit score declined. BNPL creates the risk of consumers chalking up more credit card debt to pay off BNPL obligations. In November, the Australian Securities and Investment Commission found that 15% of Australian consumers took out an additional loan to pay off their BNPL plan. Such statistics show that BNPL is an unviable payment solution, causing harm to consumers.

Buy Now Pay Later is ringing alarm bells due to its unregulated lending landscape. The lack of regulation makes it difficult for regulators to know if such services are treating customers fairly. As aforementioned, BNPL is the next hidden source of consumer debt, forcing the FCA and other regulatory bodies to intervene. The FCA are expected to introduce rules for interest-free BNPL in 2022. Further new BNPL regulation will also include checks on a customer’s ability to repay their BNPL loan. In doing so, regulators ensure that consumers do not take on more debt than they can handle.