At KFX Services we aim to answer any FAQs you may have. Our goal is to enhance your customer experience through answering such FAQs. Below are a list of common FAQs (Frequently Asked Questions):

FAQs:

Getting Started

How much does it cost to sign up with KFX?

This tends to be a common FAQ, and our answer is nothing! There’s no fee to sign up and open an account with KFX and once signed up you are under no obligation to trade. Once you’ve signed up, we’ll assign you an account manager who will manage your relationship and assist you with any transaction you decide to undertake.

We will give you your own personal login to KFX and our online platform. This will allow you to manage your own account and will allow you to initiate your currency transfers for free.

How do I get started with KFX?

Another common FAQ is how to sign up. Signing up is easy and will take no more than 5 minutes. Sign up here for a Personal Account or a Business Account

In some cases, for your security, once you have signed up, we may need some documents from you to prove your identity and/or address. We can accept a clear photographic image or scan of a document in any of the following file types: JPG,PDF,TIF,GIF,PNG.

You can upload documents within “My Account” or email info@advisorykonnect.com

Operating Your Account

Where can I make payments to?

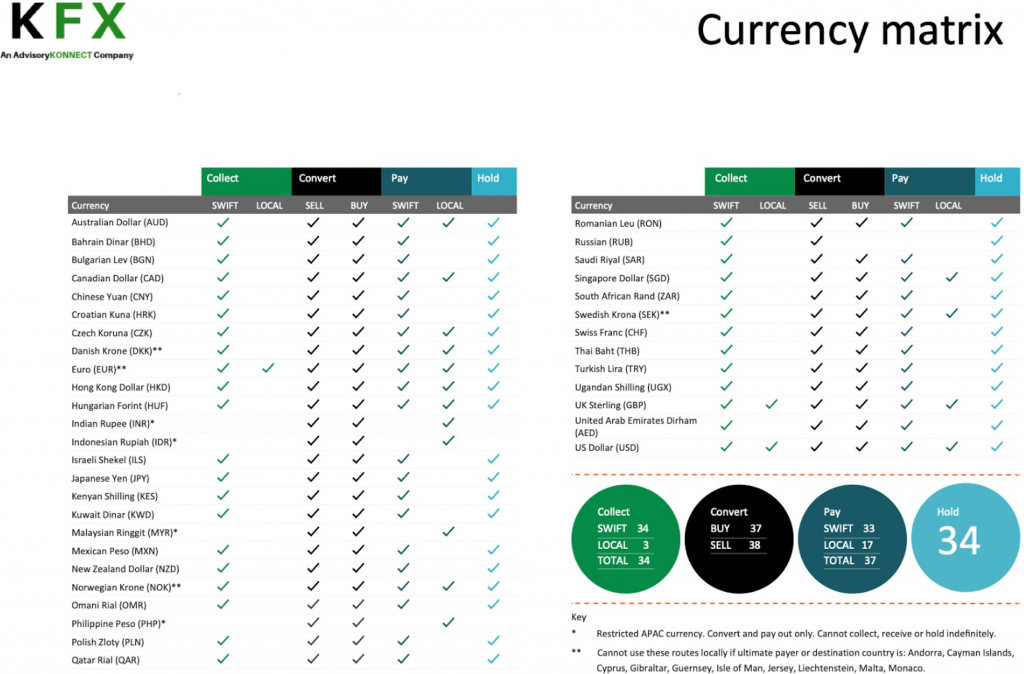

You can make global payments to over 212 countries in over 36 currencies. Please refer to the currency pair support tab above and this will provide details of each of the currency pairs that are available for each selling currency.

What currencies can KFX receive funds in?

We offer a range of currencies from many countries.

What is a currency cut-off time?

The currency cut off time is the latest time KFX can receive funds and/or a payment instruction so that outward payments can be executed on the value date shown. We will still process payment instructions that miss the cut-off time on the same day where possible, but they may be sent with a future value date.

How do I pay KFX for my trade?

We accept settlements for your trade via electronic payment. Once you have booked your trade, we will provide the bank account details and reference number to send the funds to. We do not currently accept any other forms of payment including credit card, cash or cheque.

Why does KFX sometimes ask for additional information for a beneficiary (e.g. date of birth)?

To ensure we comply with the sanctions policy, we must provide the required level of information for beneficiaries and clients. Whilst we will try to screen the beneficiary online to find this information, where it is not possible to get this we’ll ask you to provide key information and thus answer key questions such as date of birth, nationality and country of residence.

As sanctions lists are updated daily, we may ask for you to update existing beneficiary information.

How quickly can KFX receive funds?

Unfortunately, we’re unable to control the speed at which funds are received as this is dependent on the value date set by you and the speed of your bank to process the payment. Typically, we’ll receive funds on the same day or up to 3 business days if your bank is not part of the faster payments network. You can check if the funds have been received by KFX by checking your KFX Online account 24/7

My client hasn’t received their payment, what should I do?

Firstly, check the value date and the currency pair. Non-G10 currencies can take between 3 – 5 days to clear and non-arrival on the specified value date is not unusual due to bank delays within the payment routes. We always aim to send funds in the most efficient way possible.

If the currency payment hasn’t arrived, you can use the MT103 (found on page 2 of the payment receipt) to help the beneficiary bank locate the payment.

If it can’t be located and more than 24 hours have passed since the expected value date, please contact our operations team – +44 (0)203 371 7394 – who will initiate a payment investigation.

What is an MT103?

An MT103 SWIFT message is the most common international payment message type for the SWIFT network. It is a standardised message which contains all the information about payment and allows us or the beneficiary bank to trace payments when needed.

My payment has arrived but it’s less than the amount I sent. Why?

This will be due to unaccounted for intermediary fees applied by the sending or receiving bank. KFX always uses the most efficient payment routes and makes every effort to cover these fees but on occasions they will be outside of our control. KFX receives no part of this fee.

What is my client number?

You can find your client number at the top left-hand side of your dashboard. You can use this personal account number as a reference for all communications between yourself and us.

My beneficiary has received a different currency than they were expecting. Why?

If your beneficiary’s bank account holds currencies which are different to that which was sent it may have been converted by their bank upon receipt. To avoid this happening, please ensure your beneficiary gives your account details for accounts which are the same currency as the currency you are sending to them.

How much can I transfer with KFX?

The amount you can transfer is unlimited. You can transfer £50 – £300,000 (or currency equivalent) online. You can make larger transfers through an Account Manager.

What rate will I get?

Our exchange rates are linked to the live foreign exchange markets. When the markets are open, the exchange rate you are offered will often fluctuate right up until the moment you confirm your transaction. Your exchange rate is only fixed once you’ve confirmed your transaction.

How do I make an international payment with KFX?

Simply log in to your account to make a transfer or get a quote.

Confirm the currencies you would like to exchange

Enter the amount you want to transact Tell us where we need to send the purchased currency

Confirm how you will be paying us

Agree to the exchange rate and total cost

What happens next?

We will keep you informed and send you an email when we receive your funds and also an email when your payment is released by us. Please allow 1-4 working days for the beneficiary bank to credit the funds to the recipient account.

How do I amend my recipient details?

If you need to change your recipient details after you have assigned them to your payment, please contact us immediately on: 0203 371 7394.

How long does it take for regular payments to be delivered?

Sending money via regular or local payments is expected to arrive anywhere between the same day and three days, depending on a number of factors. For a detailed schedule of how long it takes to make regular payments, view our payment timelines.

What information is mandatory for my payment?

Information that is required for your payment depends on the payment type (local or standard/SWIFT payment), originating country, payer country, payer legal entity type, beneficiary country, beneficiary entity type and payment destination country.

Can I cancel my transaction?

Please contact us immediately on 0203 371 7394 should you need to cancel your transaction. This will result in us entering into a reversal transaction which may incur a closeout cost to you.

What do I do if my payment hasn’t arrived?

If the payment has not arrived with the recipient after 4 working days of you receiving the payment confirmation, please contact us on 0203 371 7394 and we will investigate and answer your questions.

I have traded the wrong amount, how do I amend it?

If you’ve bought too much, you will need to split the excess amount that you don’t need from the conversion and then cancel it. This can be achieved in two steps:

Using the ‘split’ button on the conversion details page, split the excess amount that you don’t need from the conversion. This will create a new conversion with the specified amount and the existing conversion amount will be reduced accordingly.

Using the ‘cancel’ button on the conversion details page for the new conversion created with the excess amount, cancel this. The relevant cost for this cancellation will be provided both before and after the cancellation.

I have booked with the wrong conversion date, how do I change the date?

If you’ve booked a conversion with the wrong conversion date, you can change this by clicking on the ’Date Change’ button on the conversion details page of the relevant conversion. A screen will be presented where you can define the new conversion date. Before the date change is executed a quote of how much this change will cost will be provided on the screen. After the date change is executed, the confirmed cost will also be presented.

I can’t get a rate for my conversion, what’s wrong?

You can convert currencies on our payment platform 24 hours a day, Monday to Friday, however, some transactions face restrictions:

Forwards, TOD and TOM transactions are unavailable 22:00 to 22:03 GMT each day

Some exotic currencies may be subject to availability, depending on liquidity in the market

Some currencies may be unavailable in the event of a bank holiday

If you are unable to get a rate outside of these times, please check our system availability for the platform status update.

What happens if I don’t settle my payment with KFX on time?

If you do not settle your payment on time, your payment due date will be changed for the next day and you will be charged for each additional day that it is not settled.

To avoid additional fees, please allow enough time for your bank to send the money to the platform before the cut off times.

How do I cancel a trade?

If you want to cancel or amend a trade, please speak to your account manager directly to discuss this FAQ. The contact number is 0203 371 7394.

I booked the wrong currency – what should I do?

If you’ve booked the wrong currency pair, please contact your account manager immediately. You can reach them by ringing 0203 371 7394 and have any questions answered.

FAQs: Charges and Fees

What are intermediary fees?

Intermediary fees are those charged by banks and other intermediaries outside of those charged by KFX to make the payment. You have the option to choose if you or your beneficiary pays the intermediary fees.

What are the charges?

The above FAQ is of extreme importance to many. Whilst we always send the exact amount of money you specify in the transaction, the bank receiving your funds, or an intermediary bank, may deduct fees when crediting the payment. Unfortunately, we have no control over these charges and therefore we won’t reimburse you, should you be charged.

Safeguarding Funds

When funds are posted to your account, e-money is issued in exchange for these funds, by an Electronic Money Institution who we work with, called

Currencycloud. In line with regulatory requirements, Currencycloud safeguards your funds. This means that the money behind the balance you see in your account is held at a reputable bank, and most importantly, is

protected for you in the event of Currencycloud’s, or our, insolvency. Currencycloud stops safeguarding your funds when the money has been paid out of your account to your beneficiary’s account.

* Russian Ruble (RUB) – Please note that we’re not currently supporting RUB transactions due to the conflict in Ukraine.

We hope we have answered any questions you may have in the above FAQs. However, if you have a question not included in the FAQs listed above, please contact us, and we will be sure to answer it as well as include your question on our list of FAQs.