The rise of Fintechs, interconnectivity and multiple payment forms created a new age of financial crime, making it difficult for regulators to monitor. The United Nations Office on Drugs and Crime estimated that each year 2-5% of GDP, i.e. $2 Trillion, is laundered costing the economy between £24 billion each year. The opportunity for money laundering is extremely high, and is only enhanced with the development of technology. In order to keep up with technological innovation, financial institutions must tailor their risk-based approach to tackle financial crime, with the help of anti-money laundering (AML) initiatives. Whilst many companies have implemented AML, they have done so ineffectively. In February 2021, 28 financial institutions were fined for AML violations in 2020, equating to £2.6 Billion. Organisations must use technological innovation effectively to ensure concrete AML practices are implemented, protecting both the organisation as a whole, and its customers.

What is AML?

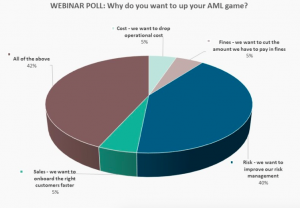

AML is a set of laws, regulations and policies used to stop individuals from generating income illegally. Thus far, AML practices have been set up to catch criminals via traditional banking institutions. As 42% of senior bankers cited outdated legacy systems as an issue for poor AML, such policies have been slow to catch criminals. In today’s age, AML risks are enhanced due to the anonymity of Blockchain, poorly defined regulation, and higher risks associated with payment methods like e-wallets and online transactions. In 2018, fines for money laundering increased by 40%, with the damage to customer trust and reputation being far greater than the actual fines themselves. AML should be a key component of digital transformation, providing security to customers, as well as minimising risks for organisations as seen in figure 1. Financial institutions must now comply with a new web of legal frameworks and AML directives, leveraging digital technologies and frameworks to tackle money laundering effectively and flexibly.

Figure 1: Why do you want to up your AML game? (Euro Money)

Artificial Intelligence:

Whilst there are various different initiatives that are in place to help minimise money laundering, they only address 99% of the market. 1% of market access is enough for criminals to benefit and move money illegally. 42% of senior banks name outdated legacy systems as barriers to embracing AI and machine learning (ML) to tackle money laundering. Thus far, only 15% of organisations use AI to detect fraud, given its ability to close jurisdictional loopholes. AI helps organisations think the way criminals do through smart monitoring and analytics. To implement AML, AI must be used to unlock data, allowing for analysis of transactions in real time. AI can anticipate and react to fraud that is invisible to the human eye, identifying the needle in the haystack. As AML systems generate many false positives, implementing AI and ML allows for banks to have a system that verifies and identifies customers efficiently. AI and ML helps to reduce the burden of being vigilant, increasing control over AML processes. According to a survey conducted by The Banking Circle, 23% of bankers named improving AML processes as their main IT priority. Given that AI is merely and enabler, and only one dimension in tackling fraud, companies must use various fraud detection tools and have access to high quality data on their customers in order to detect suspicious activities.

KYC & Compliance:

AML is a challenge as it is time consuming for many organisations to comply with regulations. Furthermore, the problem with many organisations is that the current software and practices in place presents 1000s of alerts per day, forcing employees to go through them manually. Doing so is extremely tedious and time consuming for employees, forcing them to delay filing suspicious activity reports (SARs). It took banks like Barclays and HSBC 1,205 days to report a suspicious activity. Sweden’s oldest bank, Swedbank failed to implement AML and went under investigation after billions of dollars were suspiciously moved between 2007 and 2015. It is essential for banks to implement AML initiatives such as improving employee knowledge and education on money laundering crimes. Training employees to report suspicious activity is essential, as in many cases it is not the bank’s ability to detect money laundering that is the problem, but rather the unwillingness of employees to files SARs. As such, improving training, support and employee assistance is essential when introducing AML procedures.

Data:

If a consumer’s trust is to be upheld, privacy must be balanced with security, transparency and fairness. Data is a key component in AML, hampering any initiatives if poorly organised. In order to ensure that operations are streamlined, technology like AI, ML and RPA are effective, and employees have more time to focus on higher levels of risk, forensic data analytics (FDA) and entity resolution must be implemented. Both technologies are the future of AML, with FDA collecting and analysis data to manager fraud, legal and compliance risks, and entity resolution streamlining and comparing data sets, flagging any suspicious transactions.